The Cannon County Reporter Continues

To Deliver Distorted Opinions & Fake News

On July 14th the Cannon County Reporter went on another rant of half truths and misinformation not only in a misleading editorial blurb by John Wilkinson about the budget committee action, but by allowing false information to be posted by a follower with an obvious agenda without correction or question.

The headline read, “Budget Committee Passes 55% Tax Increase... Passage By Commission Will Make Cannon County Highest Taxed County In Tennessee”

While the percentage was close, it wasn’t 55%, it was actually closer to Actually closer to 52% or .052364 to be exact.

The reporting just goes downhill after that. The next Fake News assertion comes in the form of a question: “Have two decades of financial mismanagement come down to this?”

I challenge John Wilkinson to provide evidence of “two decades of financial mismanagement”.

While there can be no question that the $1,000,000 of misspent wheel tax funds that must now be repaid to education debt service fund have created an absolute mess. But it is and out right lie to say, “The voters must be reminded that the $1,000,000 that created this mess was pledged to only be paid to the education debt service...” That statement is just not true. It is Fake News.

Although the budget committee does not have the authority to “vote to raise taxes” Wilkinson did get the dollar amount that the committee was recommending to the County Commission as a tax increase which was $1.44.

Here is where the propaganda man excels. Any follower of Wilkinson can say anything they want and rarely will they be corrected or even challenged or held accountable for their words unless of course they cross that line suggesting that John is wrong. Challenge John and he and Corey Davenport come unglued. He who comes to mind often babbles under the handle I call the “Fix It Guy” who frequently uses trash talk that would embarrass a drunken sailor. He tick off the propaganda machine when he also pointed out John Wilkinson is not a payer of Cannon County property taxes.

In this particular “Fake News” case it is a post by a young guy who used to work for the sheriff -

Skeeter Curtis posted this unchallenged comment to John’s rant about the tax increase: “This is the exact reason why the younger generation will not build or buy homes in Cannon. Being a recent new home buyer, we have to pinch every penny as it is. If I am doing my math correctly this tax increase will raise my payment $200 a month. This amount is detrimental to our budget as a family. Not to mention that the value of our property will now decrease, due to no one ever wanting to live in this county. I believe that if it had been me mishandling the money I would have already been placed into custody.”

Whoa -

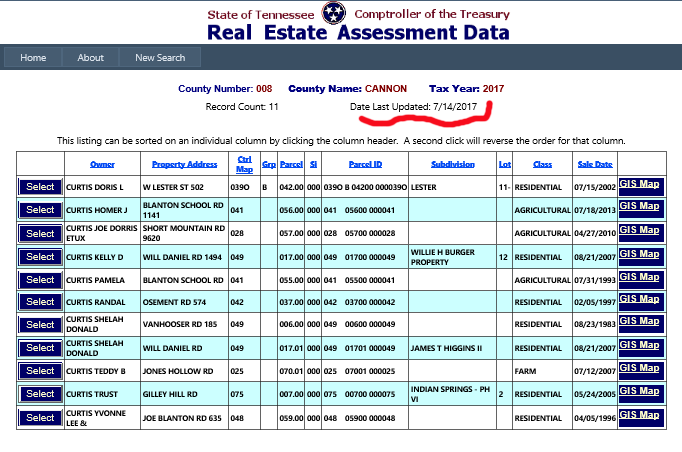

In attempt to verify the truth of the post I searched the online property owner records for a property that match what was described in the post: Owned by Ethan or Skeeter Curtis, and recently purchased. Here is what I found:

Tight budgets are forcing some law enforcement agencies to restrict officers from taking their patrol cars home.

Here is a little education on Tennessee property taxes. To calculate the tax on your property, multiply the ASSESSED VALUE by the TAX RATE. Assume you have a house with an APPRAISED VALUE of $100,000. The ASSESSED VALUE is $25,000 (25% of $100,000), and the TAX RATE has been set by your county commission and in this case Cannon County is at $2.74 per hundred of assessed value.

In the example of a $100,000 home the assessed value would be $25,000 divide that by 100 to get the “per hundred” which is 250 and then multiply that number by the tax rate – 250 X 2.75 = $687.50 in taxes.

We looked for something to compare with Skeeter’s claim. Obviously we could use John Wilkinson because he doesn’t own property in Cannon County. (In a related issue, that is why John Wilkinson is not legally qualified to be on the Cannon County Industrial Board)

So we turned to his buddy Corey Davenport. Corey ad Dana own property just across the street from his mommy-

The value of property is currently appraised by the Tax Assessor at $176,500 and accessed at 25% = $44,125. Do the math for the current taxes divide by 100 = 441.25 x 2.75 equals $1213.44 in taxes

So in anticipation of a $1.41 tax rate increase do the same math raising the tax rate to 4.19 and you discover $176,500 accessed at 25% = 44,125 divided by 100 = 441.25 x 4.19 = $1848.84 in taxes.

The additional tax burden under the proposed tax increase will raise Corey & Dana's tax $635.40. Divide that by 12 and it equals in increase of $52.95 each month.

Based upon that information, using a little reversed math and hit and miss calculations, we have determined for Skeeter Curtis’ statement to be true, he would have to have recently purchased property in Cannon County valued at around three quarters of a million dollars.

$750,000.00 accessed at 25% = 187,500 divided 100 =1875 x 2.75 = $5156.25 in current taxes.

$750,000.00 accessed at 25% = 187,500 / 100 =1875 x 4.19 = $7856.25 under the proposed increase.

If Skeeter Cutis owned a home in Cannon County valued around $750,000, the additional tax burden under the proposed tax increase would raise Skeeter's tax $2700. Divide that by 12 months and that is $225 each month -

It is the responsibility of the editor of the Cannon County Reporter, who is John Wilkinson influenced by Corey Davenport and other members of the Cannon County Republican Party to watch for those inaccuracies. Obvious inaccuracies need to be corrected! If they are not corrected and allowed to remain unchallenged, you are promoting Fake News.

And that folks is how you make a case exposing a Fake News Source!!!!

Copyright © All rights reserved. Made by Jim Gibbs. Terms of use | Privacy policy